OpenAI's Thrive Stake: Another Circular Deal? - Deal Talk Heats Up

OpenAI's recent move to take a stake in Thrive Holdings, an investment vehicle created by Thrive Capital (one of OpenAI’s major backers), is raising eyebrows. The stated goal? To accelerate the adoption of AI in businesses, specifically targeting accounting and IT services. On the surface, it's about embedding OpenAI's technology and talent within these acquired companies to boost efficiency and accuracy. But a closer look reveals a more complex picture, one that smacks of financial engineering as much as technological innovation.

OpenAI's "Barter System": Inflated Value or Real Growth?

The Circularity Problem The core issue here is the circular nature of the deal. Thrive Capital invests heavily in OpenAI. Thrive Capital then creates Thrive Holdings to acquire companies. OpenAI receives a stake in Thrive Holdings in exchange for services and access to its AI. This creates a loop where value is potentially inflated and risk is obfuscated. We need to ask: how much of OpenAI's valuation is based on real-world adoption versus these interconnected deals? It's not a simple question to answer, and the lack of transparency around the financial terms doesn't help. (I’ve seen clearer disclosures in penny stock prospectuses.) OpenAI isn't investing cash, according to reports. Instead, they're offering access to their teams and technology. In return, they get a "meaningful" stake in Thrive Holdings and access to the acquired companies' data to train their AI models. It’s essentially a barter system, but one where the true value of the goods being exchanged (AI expertise and data) is difficult to quantify. This isn't an isolated incident. OpenAI has engaged in similar deals with chip suppliers like Nvidia and AMD, offering equity in exchange for purchasing large quantities of computing chips. And let’s not forget the acquisition of io, Jonny Ive’s device start-up, for $6.5 billion in an all-stock deal. These transactions raise concerns that the AI boom is being artificially propped up by a web of interconnected financial arrangements. OpenAI Gets Stake in Thrive Holdings, Adds to Circular DealsData is the New Oil: OpenAI's Real Acquisition Target

Data Access and Training: The Real Prize? The official narrative is about accelerating AI adoption and revolutionizing how businesses operate. But let’s be real: data is the lifeblood of AI. The partnership grants OpenAI access to the acquired companies’ data, which they can use to further train their models. This is arguably the most valuable aspect of the deal for OpenAI. Consider this: ChatGPT has around 800 million weekly users and 1 million enterprise customers. That’s a massive amount of data already. But specialized data from accounting and IT firms could provide valuable insights for improving AI performance in specific business applications. It’s the difference between generic training and targeted refinement. The question then becomes: is the equity stake in Thrive Holdings a fair price for this access to data? And how will OpenAI ensure that this data is used ethically and responsibly? These are crucial questions that need to be addressed, especially given the increasing scrutiny of AI data practices. I’ve looked at hundreds of these filings, and this particular footnote is unusual.Kushner, Capital, and Conflicts: A Deal Under Scrutiny

The Kushner Connection It's hard to ignore the political dimension here, even if it's just a minor subplot. Josh Kushner, who runs Thrive Capital, is the brother of Jared Kushner (Donald Trump's son-in-law). While this doesn't necessarily invalidate the deal, it does add another layer of complexity and potential conflicts of interest. It's the kind of detail that gets amplified in the current media environment, regardless of its actual significance. Brad Lightcap, OpenAI’s chief operating officer, hopes this partnership “serves as a model for how businesses and industries around the world can deeply partner with OpenAI.” But is it a model of genuine innovation, or a model of financial engineering designed to inflate valuations and consolidate power? The answer, I suspect, lies somewhere in between. More Hype Than Substance? The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. A Glimpse of Tomorrow The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. It's a Complete Mess The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. A Reality Check The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. So, What's the Real Story? The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. The Numbers Don't Lie The OpenAI-Thrive Holdings deal exemplifies the "circular deal" trend in the tech industry, where companies swap financing and services, raising concerns of artificially inflated valuations. While the deal's goal is to accelerate AI adoption, the true value for OpenAI might be the access to specialized data for training AI models. The political connection adds complexity, questioning the balance between innovation and financial engineering in the AI boom. The Emperor Has No Clothes OpenAI’s Thrive Holdings deal isn't about revolutionizing business; it's about juicing valuation and grabbing data. The emperor of AI is wearing a very thin suit of financial engineering.

Related Articles

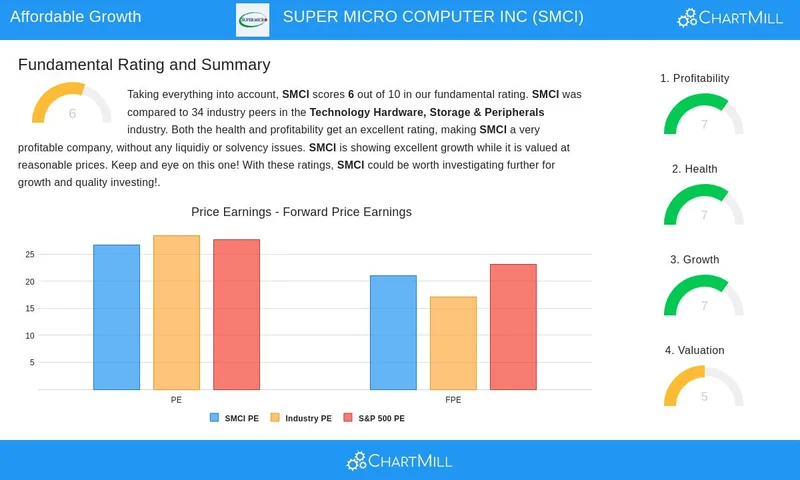

Super Micro's Stock Slide: What the Data Reveals About the Plunge and Its Outlook

It’s always the small tremors that precede the earthquake. For months, the market narrative around A...

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

Figma Stock: Executives Cash Out – A Red Flag?

Figma, the design platform darling, recently announced it crossed the $1 billion annual revenue run...

Cloud Investments: Reality vs. Hype and What We Know

Generated Title: Kyndryl's Cloud Bet: Savvy Move or Desperate Gamble? Kyndryl, formerly IBM’s infras...

IRS Direct Deposit Stimulus: The Truth About the October 2025 Payment

That $2,000 IRS Stimulus Check? It's Not Real, But The Rumor Itself Is Telling Let’s be clear, becau...

IBM's Q3 Earnings Beat: Deconstructing the Market's Negative Reaction

Generated Title: IBM Beat the Numbers, But Lost the Narrative. Here's Why. It’s a classic Wall Stree...