Global Growth Faces Tariff Headwinds: But AI Investments are Our Unstoppable Engine for a Brighter Future

Truist's Quiet Q3 Win: A Glimpse into Banking's Tech-Driven Future

Truist Financial Corporation (TFC) might not be grabbing headlines with flashy metaverse announcements or cryptocurrency ventures, but its recent Q3 performance, subtly outperforming expectations, hints at something far more profound: the quiet revolution of technology reshaping the very foundations of banking. A 4% dip from its 52-week high? A slight underperformance compared to the S&P 500? Is Truist Financial Stock Underperforming the S&P 500? - Yahoo Finance These are blips on the radar compared to the real story brewing beneath the surface.

Look, the market often chases the shiny new object, the promise of instant riches, but true innovation, the kind that lasts, is often the result of steady, consistent, and yes, even *boring* improvements in core infrastructure. TFC's Q3 revenue of $5.19 billion, beating estimates, and an adjusted EPS of $1.35, exceeding expectations by a whopping 35.9%, isn't just luck. It's a testament to a strategy that prioritizes smart tech integration, streamlined operations, and a deep understanding of its customer base.

Truist: Building the Foundation for Future Finance

Beyond the Balance Sheet: A Tech-Forward Bank This isn't your grandfather's bank anymore. We're talking about a large-cap player, a $59.5 billion entity, strategically positioning itself for a future where banking is less about brick-and-mortar branches and more about seamless, personalized digital experiences. Imagine a future where AI-powered insights anticipate your financial needs before you even realize them, where transactions are frictionless, and where financial advice is tailored to your unique circumstances. That's the potential TFC is tapping into. It's like comparing the printing press to the internet. The printing press revolutionized information dissemination, but the internet personalizes it, makes it interactive, and puts it at your fingertips. This is what TFC is doing with finance! And let's be honest, banking hasn't always been known for its cutting-edge tech. But what if institutions like Truist are quietly building the infrastructure that will power the next wave of fintech innovation? What if their size and stability give them an advantage in deploying AI, machine learning, and data analytics at scale, creating efficiencies and customer experiences that smaller startups can only dream of? It's a fascinating question, isn't it? To what extent can traditional banks adapt and innovate, and what will be the ultimate outcome? Consider this: TFC's stock has been trading above its 200-day moving average since late June and above its 50-day moving average since early November. This isn't just a technical indicator; it suggests a sustained period of stability and growth, fueled in part by these strategic tech investments. Fifth Third Bancorp (FITB), by comparison, is lagging. Is this a sign that TFC's approach is resonating with investors who are looking for long-term value rather than short-term hype? I saw a headline recently that called TFC's performance "underwhelming." Underwhelming? I think that misses the point entirely! It's like calling the foundation of a skyscraper "unimpressive." You don't see it, but it's what allows everything else to stand tall. When I look at Truist’s results, I see a company laying the groundwork for a future where banking is not just a service, but a seamless, intuitive, and personalized experience powered by technology. This is the kind of breakthrough that reminds me why I got into this field in the first place.Future-Proofing Finance: Tech as a Strategic Imperative

A Financial Future, Reimagined The key here isn't just about beating earnings estimates; it's about building a resilient, future-proof business model that can thrive in a rapidly changing landscape. It's about embracing technology not as a cost center, but as a strategic asset that can drive growth, improve efficiency, and enhance the customer experience. Of course, with this power comes great responsibility. We need to ensure that these technologies are used ethically and responsibly, with a focus on fairness, transparency, and data privacy.The Quiet Revolution is Here

The Quiet Revolution is HereRelated Articles

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

Applied Digital's Earnings Report: What to Expect and What It Signals for the Future of AI

Yesterday, for a few dizzying minutes after the market closed, it looked like the story might be a s...

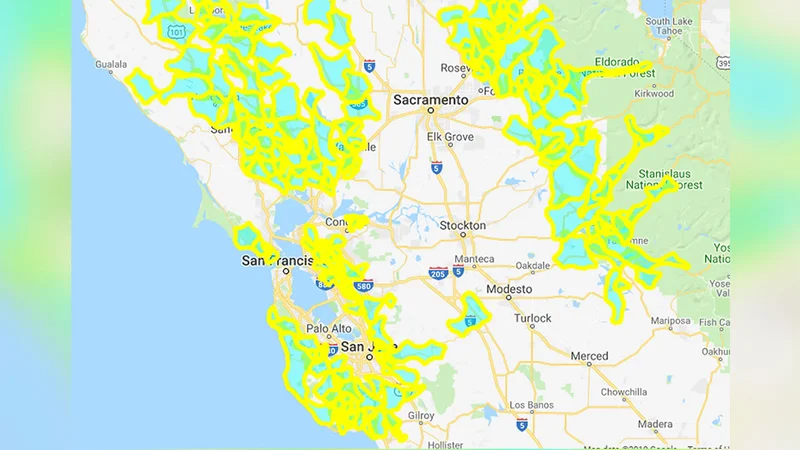

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Comcast's Stock Is Finally Paying the Price: Why It's Tanking and the Corporate Excuses You're Supposed to Believe

A Confession, Not a Notice So, Comcast’s stock took a little dip the other day. Wall Street gets the...

Bitcoin: Fed's $29.4B Injection – What the Hell Does It Mean?

Okay, so the Fed injected almost 30 billion bucks into the banking system last Friday. $29.4 billion...

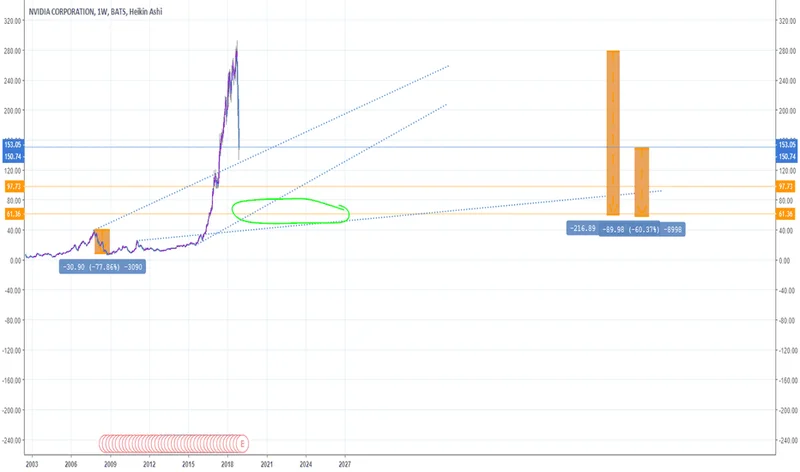

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...