Futures Outage: Fed Cut Bets Prove It's Rigged. - Traders in Shambles

Wall Street's High on Hopium Again? Bitcoin Says "Hold My Beer."

So, here we go again. Wall Street's all hot and bothered about the Fed maybe, just maybe, hinting at a rate cut next month. 85% probability, they're saying? Give me a break. It wasn't that long ago they were screaming about inflation being here forever. Now suddenly, it's all sunshine and lollipops because some Fed governors mumbled something vague?

Data-Starved Decisions & Bitcoin's Cliff Dive

The Data Dumpster Fire Let's be real, this whole situation is built on a foundation of sand. The article mentions a "record 43-day US government shutdown" that starved everyone of data. And *that's* what they're using to make these monumental decisions? Seriously? It's like trying to navigate a minefield with a blindfold on. "Oh, but the market *feels* good!" Yeah, well, my gut *feels* like pizza tonight, but that doesn't mean it's a good idea. And Bitcoin's reaction? A 16% nosedive over the month. Usually, Bitcoin's the canary in the coal mine for risk appetite, but this time it's more like a drunken sailor stumbling off a cliff while everyone else is partying on the deck. Is Bitcoin finally wising up, or is it just having a really bad month? Markets Bet On Fed Cut While Bitcoin Loses Its Nerve.Global Monetary Mosh Pit: Who's Throwing Elbows?

The Global Jigsaw Puzzle of Doom The article touches on the policy crosswinds, and that's where things get truly Kafkaesque. The ECB is playing it cool, Japan's thinking about ditching negative rates (finally!), and Australia and New Zealand are yawning and stretching after their tightening cycles. It's a global monetary policy mosh pit, and everyone's throwing elbows. This "regional divergences and selective themes" nonsense they're selling is just a fancy way of saying "we have no freaking clue what's going on." Oh, and let's not forget the CME Group's data-center outage. A "brief" freeze in futures trading during a shortened post-Thanksgiving session. Translation: a perfect storm of low liquidity and technical glitches that probably sent a few algorithms into a panic spiral. It's like the financial system is held together with duct tape and crossed fingers. Then again, maybe I'm just being cynical. Maybe this time it's different. Nah.Yen "Steadying"? More Like Delayed Disaster.

The Yen's "Steadying"? Yeah, Right. The yen's "steadied around ¥156.4 per dollar," they say. Steady like a toddler who's had too much sugar. The only reason it's not in freefall is that the Bank of Japan is making vaguely threatening noises about maybe, possibly, considering a rate hike. It's economic kabuki theater, and we're all forced to watch. So, What's the Real Story Here? It's all a house of cards built on hope and wishful thinking. The Fed's probably going to blink, Wall Street's going to throw a party, and Bitcoin will either bounce back or crater completely. Me? I'm stocking up on popcorn.

Related Articles

Nvidia News Today: What's Happening and What It Means

Nvidia's AI Play: A Glimpse into the Next Decade Nvidia. The name is practically synonymous with the...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...

The Fed's Big Rate Cut Promise: And the Mess It Made for Your Mortgage

So the Fed finally did it. They cut the interest rate. You can almost hear the champagne corks poppi...

AMD's AI Leap: What Happened and the NVIDIA Rivalry

Intel's Loss, AMD's Gain: Is This the AI Tipping Point We've Been Waiting For? The news is rippling...

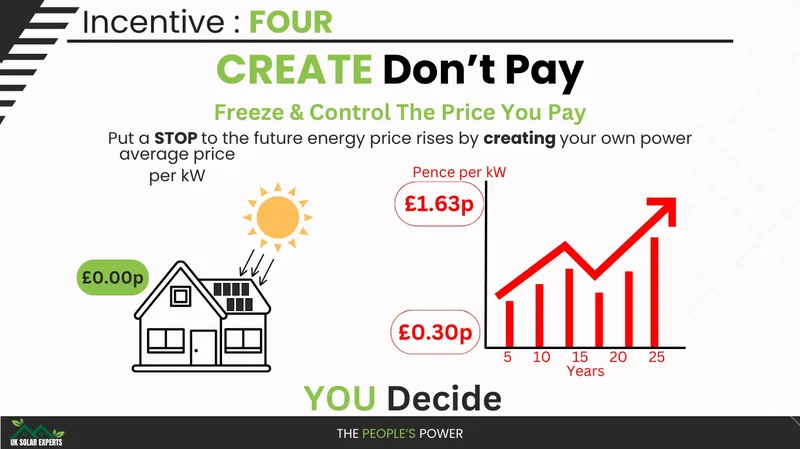

Solar Incentives: Who Benefits and What's the Catch?

Solar's "Silver Linings"? More Like Fool's Gold. Alright, let's get one thing straight: "silver lini...