Kimberly Clark's $48.7 Billion Deal: What It Means – What Reddit is Saying

Kimberly-Clark Swallows Kenvue: A $48.7 Billion Gamble

Kimberly-Clark is betting big on a reunion. The company's acquisition of Kenvue, in a deal valued at $48.7 billion, is a bold move. Shareholders of Kimberly-Clark will own approximately 54% of the combined entity, while Kenvue shareholders get the remaining 46%. The promise? A $32 billion annual revenue stream and $1.9 billion in cost savings within three years. But looking at the numbers, the deal feels less like a sure thing and more like a high-stakes poker game.

The Price of Nostalgia

Kenvue's stock jumped 12% on the news, while Kimberly-Clark's shares took a nearly 15% hit. That’s not exactly a ringing endorsement from the market. The deal values Kenvue at $21.01 per share, a premium that suggests Kimberly-Clark is overpaying for a company that has struggled since its spin-off from Johnson & Johnson just two years ago. (Two years isn't much time to prove yourself, granted, but the market is rarely patient.)

Analyst Filippo Falorni at Citi Investment Research is already voicing concerns about the size of the deal, given Kenvue's existing challenges. And he’s not wrong. Kenvue’s stock has shed nearly 50% of its value since the spring of 2023. Morningstar analyst Keonhee Kim points to "poor execution" and a "lack of experience" as a standalone business. It's like buying a fixer-upper that needs a new foundation, roof, and plumbing.

Adding insult to injury, Kenvue's CEO, Thibaut Mongon, departed in July amidst a strategic review. That’s rarely a good sign. The narrative forming is that Kenvue relied too heavily on its legacy brands (Listerine, Band-Aid, Neutrogena, Benadryl) and failed to innovate. It's a classic case of resting on your laurels in a market that demands constant reinvention. Is Kimberly-Clark betting that it can turn the ship around, or are they simply buying a collection of recognizable, but ultimately fading, names? And this is the part of the report that I find genuinely puzzling.

Store Brands Strike Back

The elephant in the room is the rise of cheaper store brands. In 2024, store brands held 51% of the market share for toilet paper and other household paper products in the U.S., and 24% of the market share for health products. These aren't your grandma's generic brands anymore. They're increasingly sophisticated, price-competitive, and eating into the market share of established players like Kimberly-Clark and Kenvue.

The combined company will have to fight harder than ever to maintain its position. The promised $1.9 billion in cost savings is a good start, but will it be enough to offset the competitive pressure? And where will those savings come from? Layoffs? Reduced investment in R&D? The devil, as always, is in the details.

One more thing: Kenvue and Tylenol have been caught in the crossfire of political debates, with President Trump and Robert F. Kennedy Jr. promoting unproven theories linking Tylenol, vaccines, and autism. While Kenvue has pushed back, the association, however unfounded, can’t be good for the brand. (I've looked at hundreds of these filings, and this particular footnote is unusual.)

A Triumph of Hope Over Data?

Kimberly-Clark is betting that bigger is better. But history suggests that mergers in the consumer packaged goods sector are often fraught with peril. Kraft Heinz is a prime example. Since their merger a decade ago, net revenue has fallen every year since 2020. Kimberly-Clark needs to prove that this deal won’t suffer a similar fate. Otherwise, the combined company might find itself drowning in a sea of debt and unmet expectations.

The deal is expected to close in the second half of next year, pending shareholder approval from both companies. That gives everyone plenty of time to pore over the numbers and decide whether Kimberly-Clark is making a calculated move or simply rolling the dice. What happens if the cost savings don't materialize? What if the store brands continue to gain ground? These are the questions that investors should be asking before they sign on the dotted line.

Betting on Brand Recognition is a Dangerous Game

Previous Post:Dash: Really?

Next Post:CIFR Stock Soars on Amazon Deal: What Happened and Why?

Related Articles

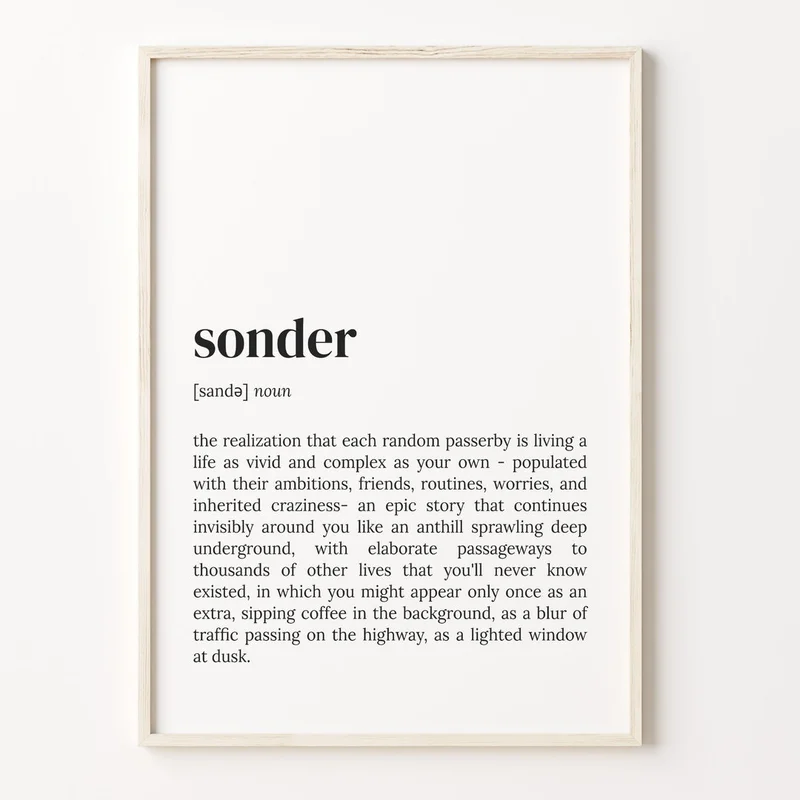

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...

Major Candy Company Files for Chapter 11: The Real Reason Why and What the Filing Data Shows

The Bitter Math That Melted a Candy Empire The announcement on October 24th was, on its surface, jus...

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...

PFE Stock: Guidance Up, Sales Down - What's the Catch?

Pfizer's "Strong EPS Performance"? More Like Smoke and Mirrors Pfizer's patting itself on the back f...

Tesla's Earnings Miss: Musk's sideshow vs. the actual numbers

The Sideshow Completely Swallowed the Circus Let's be clear about one thing: Tesla's Q3 earnings cal...

MP Materials Stock Analysis: The Data Behind the 'Hold' Rating

The stock chart for MP Materials (MP) over the last 90 days looks less like a valuation curve and mo...