DeFi's 'Recovery': Just Another Trap. (- Deep Dive)

Solana's Still a Thing? Color Me Skeptical

Okay, so Solana [https://www.coindesk.com/price/solana/] is supposedly making a comeback? I keep seeing headlines about its "high throughput" and "low transaction costs" – like that's supposed to impress me in late 2025? Give me a break. It's like bragging about having a slightly less rusty car in a demolition derby.

The "Efficiency" Hype Train

This article I'm reading claims Solana consistently hits 1,000+ transactions per second. Thousand? My grandma's got a faster internet connection. And they call that "supporting large-scale dApp activity"? What dApps? Another NFT marketplace nobody asked for?

Proof of History and Proof of Stake

And this "Proof of History" (PoH) and "Proof of Stake" (PoS) combo? Sounds like alphabet soup designed to confuse investors into thinking it's some kind of revolutionary innovation. It's just marketing, plain and simple. They're trying to make it sound like they've reinvented the wheel when, let's be real, it's still just a slightly different shaped tire.

Transaction Confirmation Times

They boast about sub-400 millisecond transaction confirmation times. Okay, cool. Can it confirm my existential dread that fast? Didn't think so.

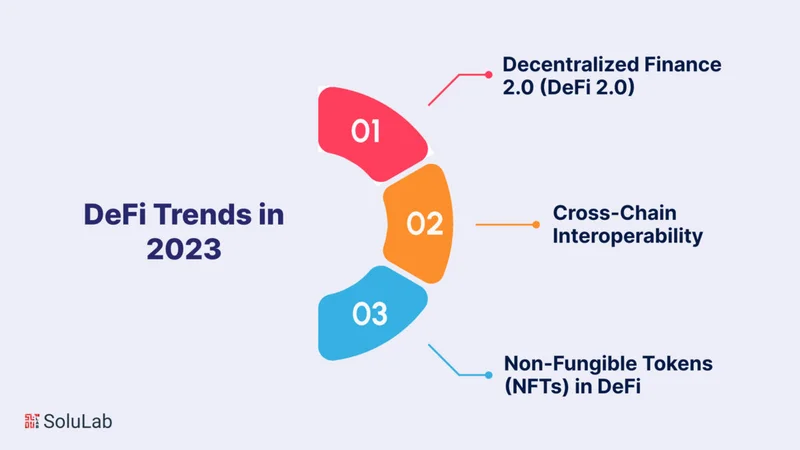

Investor "Trends": More Like Desperation

Now, here's where it gets interesting – and by "interesting," I mean "depressing." Apparently, even in the DeFi world, people are flocking to "safer names with buybacks." HYPE and CAKE are mentioned. Buybacks? In crypto? That's not a sign of strength; it's a desperate attempt to prop up a failing project. It's like putting lipstick on a pig, except the pig is a decentralized, unregulated financial instrument.

The Bar for Success

And the "fundamental catalysts"? MORPHO and SYRUP outperformed because they weren't as badly affected by some other disaster. So, the bar for success is now "less catastrophic failure"? That's the best we can hope for?

Perpetual Futures and Leveraged Gambling

I saw one analyst, Martin Gaspar from FalconX, say investors might expect "perps to continue to lead". Perps? Perpetual futures? So, we're betting on more leveraged gambling to save the DeFi space? That's genius...ly stupid. According to DeFi Token Performance & Investor Trends Post-October Crash, this trend of investors flocking to safer names is a key shift in the market.

Staking Rewards: Not Free Money

Speaking of analysts, this other article keeps mentioning "staking rewards" like it's free money. Newsflash: it ain't free. It's inflationary, and it only works if new money keeps coming in. It's a Ponzi scheme with extra steps.

My Personal Grievance (Because Why Not?)

This whole thing reminds me of my cable bill. Every month, they promise faster internet, more channels, better service... and every month, it's the same garbage, just with a slightly different name and a higher price tag. It's the same empty promises, repackaged and resold. Are we really supposed to believe the crypto space is any different?

Institutional Adoption: Not a Magic Bullet

And another thing, all these "experts" keep talking about "institutional adoption." As if that's some kind of magic bullet. Institutions are just as greedy and clueless as the rest of us, they just have more money to throw around.

Cynicism Check

Wait, am I being too harsh? Maybe. I mean, Solana's still around, right? People are still using it. Maybe I'm just too cynical. Nah, who am I kidding?

The Regulatory Sword of Damocles

Oh, and let's not forget the regulatory boogeyman. The SEC is always lurking, ready to drop the hammer on some unsuspecting DeFi project. And Europe's MiCA regulations? More red tape, more compliance costs, more reasons for innovation to grind to a halt. Asia-Pacific's licensing requirements? A bureaucratic nightmare.

Regulatory Clarity: An Oxymoron?

This article mentions that "regulatory clarity tends to boost confidence." Clarity? In crypto? That's an oxymoron. The only thing clear is that the regulators don't have a clue what they're doing, and they're making it up as they go along.

Another Flash in the Pan?

All this talk about "network performance" and "ecosystem growth" is just noise. The bottom line is this: Solana is still around, but it's not the savior of anything. It's just another blockchain fighting for scraps in a crowded market. It's a slightly faster horse in a world that's already moved on to cars. And those cars are probably electric and definitely overhyped.

It's Just a Matter of Time...

Conclusion Title:

A Glorified Spreadsheet?

So, what's the real story? Solana is a glorified spreadsheet with a fancy marketing team. It's not going to revolutionize finance, it's not going to solve world hunger, and it's certainly not going to make me rich. At best, it's a speculative asset with a slightly better chance of surviving than most of the other garbage out there. But that's not saying much.

The DeFi House of Cards

Let's be real, the whole DeFi space is a house of cards built on hype and wishful thinking. And Solana is just one of the cards. Sure, it might have a slightly shinier picture on it, but it's still just a card. And eventually, the house is going to come crashing down.

A Glorified Spreadsheet?

Here We Go Again...

Your Punchline Here:

So, What's the Real Story?

Solana's got its fans, sure. But let's not pretend it's anything more than a slightly less-terrible option in a sea of terrible options. The "high throughput" and "low fees" are nice, I guess, but they don't solve the fundamental problems of the crypto space: volatility, regulation, and the fact that nobody actually uses this stuff for anything real.

Are Blockchains Even Necessary?

It's like everyone's so busy arguing about which blockchain is the best that they've forgotten to ask whether blockchains are even necessary in the first place. Maybe I'm just getting old, but this whole thing feels like a giant waste of time and energy. And I'm out of here.

So, What's the Real Story?

Conclusion Title:

Give Me a Break...

Solana? Still breathing, I guess. But let's not act like it's winning any marathons. The whole crypto circus

Related Articles

DoorDash Stock Drop: What Happened and What We Know

Dr. Aris Thorne: NBCUniversal's Cookie Notice and the Looming AI Revolution Okay, folks, buckle up b...

Concordium ($CCD) Lists on Kraken: What the Listing Reveals About Its 'Compliance-First' Strategy

The Quiet Bet on Boring: Deconstructing Concordium's Institutional Play Another day, another token l...

Balancer Hacked: $110M Moved – What We Know and the Internet's Reactions

Balancer's $110M Hack: A Wake-Up Call or DeFi's Ultimate Stress Test? Okay, folks, let's dive into t...

Internet Computer: What's Behind the Crypto Surge?

Internet Computer's 37% Jump: A Glimpse into the Future of Blockchain Stability? Alright, folks, buc...

The Aster DEX Breakthrough: What It Is and Why It’s a Glimpse Into DeFi’s Future

A number gets thrown around in technology that is so large it almost loses its meaning: a trillion....

Zcash Surge: Privacy's Back, Baby?

Zcash's Privacy Push: Is It a Real Revolution, or Just Another Crypto Pump-and-Dump? Alright, let's...